UAE entering a significant new wave of healthcare for women

- December 20, 2021

Dubai: The UAE appears to be entering a significant new wave of healthcare for women, driven by greater awareness and openness about female health topics, changing perceptions about women’s health issues, market accessibility for female founders, increasing demand for reproductive health products and services, growing interest from VCs and angel investors in FemTech, facilitative government efforts and a number of FemTech projects set to launch in 2022 and beyond, according to the latest 2021 Global FemTech Industry report published by FemTech Analytics, a subsidiary of UK-based consortium Deep Knowledge Group.

According to the report, the US continues to dominate the FemTech market with over 50% of FemTech companies globally, followed by Europe (25%) and Asia (9%). The UK and Israel boast the highest number of FemTech companies in their respective regions with 10% and 6% of the total number of businesses, while Asia's undisputed market leader is India with 4% of FemTech companies.

The US remains the leader of FemTech investments with over $10 billion invested in US-based companies, followed by Israel with $1.25 billion, the UK with $611 million and Switzerland with $398 million. Moreover, 65% of investors in FemTech are based in the US, 7% in the UK and 3% in Canada and Switzerland. The USA also hosts the highest number of FemTech networks and accelerator programs with 32% of the global share, followed by the UK and Switzerland with 23% and 14% respectively.

“Over the past few years, we have witnessed a steep rise in FemTech solutions due to the adoption of new technologies and new business models, transforming the way women access healthcare”, said Kate Batz, Director of FemTech Analytics. “Several countries have been advancing their FemTech agendas in line with their women empowerment policies. The FemTech market is expected to grow significantly in the next few years and our study provides valuable insights into this market to all stakeholders”.

The UAE is well-positioned to achieve exponential growth within the FemTech industry, considering the array of existing startups providing feminine hygiene products and educational tools such as Pectiv, Orgabliss, MyLily and LiZZOM, and the several more expected to arise over the coming few years.

E-commerce platforms focused on women’s healthcare represent a key driver of the UAE’s FemTech sector. Digital platforms in the Pregnancy & Nursing sub sector offering consumer products for mums-to-be, new mums and kids to enjoy motherhood journey include Mama's Box, Mumzworld and BabySouk.com.

“One-third of MENA’s FemTech companies are based in the UAE, where innovation, women empowerment and gender equality are matters of national priority. Countries like the UAE are leading the way and gradually breaking down taboos surrounding female health thanks to a culture of openness, high-levels of health awareness and the tech savviness of the government, the private sector and civil society. As a result, society at large is becoming more and more receptive to engage in conversations about such topics and embrace positive change in support of the FemTech sector,” Kate added.

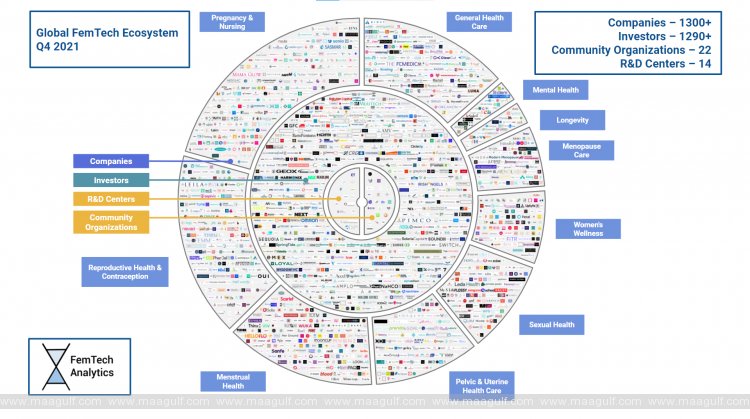

Based on the analysis of over 1,300 FemTech companies, 1,290 investors, 14 R&D centres and 22 community organisations worldwide, the 2021 Global FemTech report showcases market trends, innovations, growth opportunities and investment prospects of a rapidly growing industry. It also includes interviews with FemTech leaders, a list of the top 150 FemTech influencers and case studies featuring prominent FemTech companies.

According to the report, the total market capitalization of 28 global publicly traded FemTech companies accounted for almost $70 billion as of December 2021, with pregnancy and nursing as the largest sub sectors taking 68% of the total market.

Nonetheless, the level of investments in FemTech remains low as highlighted by FemTech Analytics’ 2021 Global FemTech Survey published in October 2021.

Additional findings:

- 85% of all FemTech companies generate annual revenues of less than $10 million each

- The FemTech companies that raised the highest amount of funds are Evofem ($444.2 million in Post-IPO Equity), Progenity ($248.5 million in Post-IPO Equity), Agile Therapeutics ($204.5 million in Post-IPO Equity), Elvie ($151.9 million in Series C round) and The Mom Project ($115 million in Series C round)

- More than 50% of FemTech companies operate in the areas of pregnancy and nursing, reproductive health and contraception and general healthcare. Companies providing pregnancy and nursing solutions such as Baymatob and Expectful make 21% of the market, the ones operating in reproductive health and contraception like Carrot and Phexxi, and general healthcare like Syantra and Tia account for 17% and 14% respectively

- Other FemTech sub sectors include Women's Wellness, Menstrual Health, Longevity, Mental Health, Pelvic and Uterine Healthcare

- Menstrual health products are among the most popular - these include reusable absorbent sanitary items, reusable cups and flushable pads providing safe, convenient, affordable and environmentally friendly options

- FemTech diagnostic solutions are dominant in general healthcare (31%), apps and software are popular in the FemTech mental health sector (33%)

- In the FemTech longevity sector dedicated to developing technologies to improve women’s lifespan, 58% of FemTech companies are based in North America and 26% in Europe where Switzerland leads with the highest number of businesses.

తాజా వార్తలు

- ఏపీ లో ప్రభుత్వ పాఠశాలల్లో సిక్ రూమ్ లు ఏర్పాటు

- ఖతార్లో పొగమంచు, అత్యల్ప ఉష్ణోగ్రతలు..!!

- ఫ్రాన్స్, పోలాండ్ చికెన్, గుడ్ల దిగుమతిపై సౌదీ నిషేధం..!!

- దుబాయ్ లో స్పిన్నీస్, వెయిట్రోస్ లొకేషన్లలో పెయిడ్ పార్కింగ్..!!

- నాన్ కువైటీలకు రుణ నిబంధనలను సడలించిన బ్యాంకులు..!!

- గ్రాండ్ ఈజిప్షియన్ మ్యూజియాన్ని సందర్శించిన సయ్యద్ బదర్..!!

- బహ్రెయిన్ లో యువత సామర్థ్యాలకు పదును..!!

- ట్రంప్ మరో సంచలన నిర్ణయం.. భారీగా పెంచేసిన రక్షణ బడ్జెట్

- బంగ్లా-పాక్ లమధ్య పెరుగుతున్న రక్షణ బంధాలు

- ఖతార్ ఫోటోగ్రఫీ సెంటర్ ఆధ్వర్యంలో 'సిటీ స్పీక్స్' ఎగ్జిబిషన్..!!